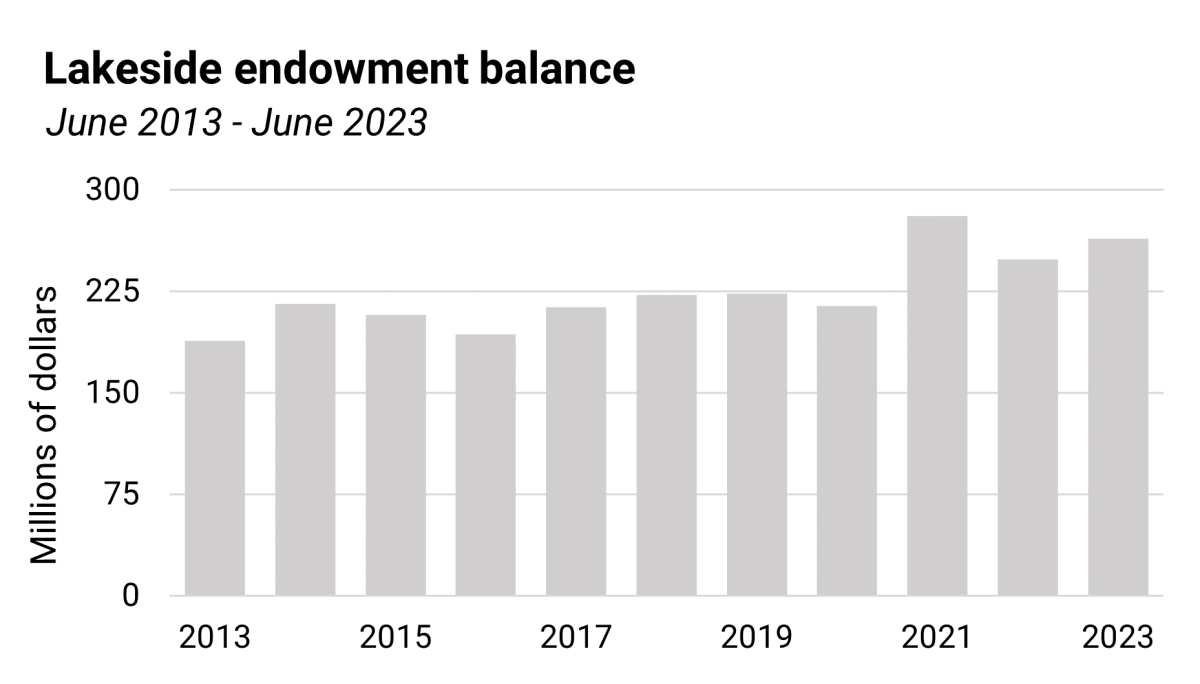

In June of 2023, Lakeside School’s endowment reached a cool $264,113,597 — its second-highest valuation in the past 10 years. How did it get there? On the back of generous donations, disciplined financial management, and recent investments in private funds. This month, “Tatler” interviewed administrators, read through hundreds of pages of public tax records, and browsed annual fundraising reports to answer all your questions about Lakeside’s endowment.

What is an endowment?

In short, it’s a gift that lasts.

Every year, Lakeside’s development team conducts outreach and leads fundraisers to sustain the school’s endowment. From a network of distinguished alumni, families, and other benefactors, the school receives donations of real estate, stock holdings, or, most commonly, money.

Under the direction of Dr. Bynum, the Board of Trustees, and outside consultants, those gifts are invested into public and private funds on Wall Street to raise income and enlarge the endowment. In return, that growth allows up to $10 million to be withdrawn and spent towards school needs every year, all while preserving sufficient funds for future generations of students.

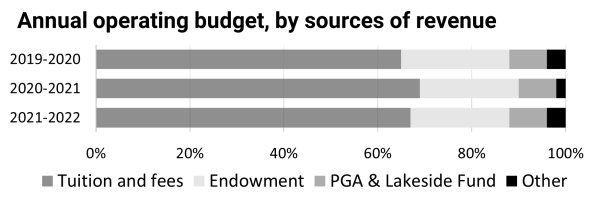

Besides endowment, other assets or sources of income — like real estate, student tuition, and the Lakeside Fund — also contribute to the school’s annual budget. Together, these funds help pay teacher salaries, give financial aid, and maintain campus facilities. They also subsidize special programs and projects like GSL trips, the construction of new buildings, COVID-19 test screenings, and more.

How much has Lakeside’s endowment grown recently?

Since 2013, Lakeside School’s endowment has increased by approximately $75 million. Not all of that additional money is available to the school — many donors impose restrictions on how their funds are spent (e.g. for assembly speakers, financial aid awards, or sports programs), while the Board of Trustees sets limits on what percentage of the endowment can be annually withdrawn (typically 4–5%). That’s in line with how much profit is forecasted in a year in the market, and how much can be safely spent without disrupting funds’ future growth.

Last year, Lakeside spent $9,203,453 out of the endowment, with money pulled from that fund accounting for 20 to 25% of Lakeside’s annual operational budget.

How does the size of the endowment compare to similar schools?

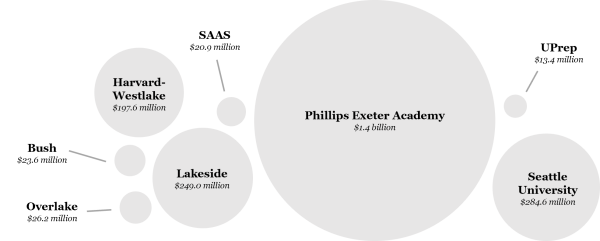

This graph is a snapshot of Lakeside’s and comparable private schools’ endowments in June of 2022 (Lakeside’s “peer schools” — with whom the Administration compares us — are other independent high schools in the Seattle area). The areas of the circles represent the relative sizes of their endowments.

By the numbers, Lakeside’s endowment exceeds Overlake’s by $222.7 million and is over ten times greater than Bush’s rainy-day fund. Though far smaller than the $1.4 billion of Phillips Exeter — the richest independent high school in America — Lakeside’s endowment stands as one of the largest on the West Coast, exceeding the likes of LA-based Harvard-Westlake. In an interview, Lakeside Chief Financial Officer Birage Tandon pointed to a combination of generous donors and wise spending policies as the reason why Lakeside is “one of the best fiscally run schools in the country.”

How does our endowment compare to private colleges and universities? In the 2022 NACUBO-Commonfund Study of Endowments, the median endowment of 678 higher-education institutions surveyed was $203.4 million — just $50 million shy of Lakeside’s. Yet compared with the most prestigious and oldest universities in America, Lakeside School is blown out of the water. Following the scale of the above graph, Harvard’s $50 billion endowment would cover approximately the area of this two-page spread. Together, these funds help pay teacher salaries, give financial aid, and maintain campus facilities.

Which investments get taxed?

Lakeside’s endowment income almost precisely reflects its investment returns. As a 501(c)(3) nonprofit, any income that is directly related to Lakeside School’s educational mission is exempt from taxation — this is standard practice for almost all private, educational institutions.

However, some forms of income qualify as “Unrelated Business Taxable Income,” including certain investment returns and sales. Several decades ago, the school chopped down several large trees on campus due to safety concerns; wood salvaged from these trees netted the school thousands of dollars, but was also taxed by the IRS. Activities that are, in the IRS’s words, “not substantially related to the purpose that is the basis of the organization’s exemption” qualify as taxable income.

What’s the relationship between Lakeside’s endowment and tuition?

Approximately 50% of annual endowment expenditures go to financial aid, a program that offers some form of financial support to a third of all attending students, thereby subsidizing a yearly tuition that currently stands at $42,000. Tuition and Lakeside’s endowment represent the two largest streams of Lakeside’s revenue as together, they finance over 85% of annual expenses.

How have tuition and financial aid responded to endowment growth?

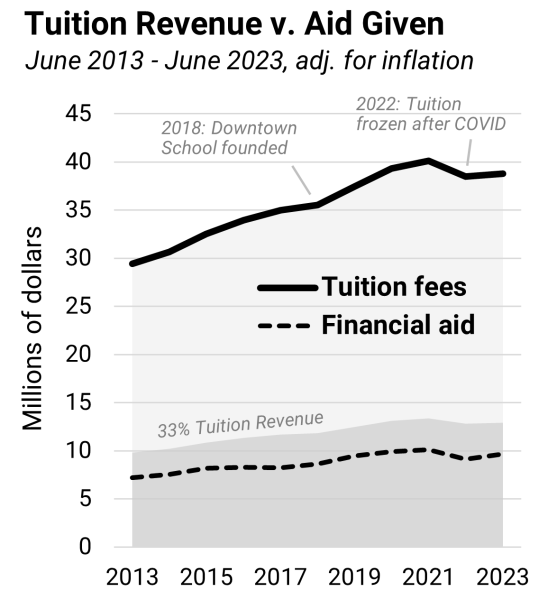

To answer this question, “Tatler” compared Lakeside’s gross tuition revenue with total financial aid granted, for every year from the 2012-2013 to the 2022-2023 school year (see figure at right). The analysis finds that despite a flourishing endowment, the school is also bringing in significantly more tuition revenue compared to ten years ago — a $9.4 million difference representing a 32% increase overall. Meanwhile, yearly tuition has increased by $13,400 since the 2013-14 school year, or close to $5,000 when adjusted for inflation. The only time when tuition did not increase came in the summer of 2021, after the height of the COVID-19 pandemic.

The price to attend is rising not just at Lakeside but also at peer schools like University Prep or Overlake. Ms. Tandon explained how, according to an economic phenomenon known as Baumol’s cost disease, wages in labor-intensive services — like teaching, health care, and more — have naturally grown in the presence of rapid technological advancements and rising productivity in other sectors. Adequately compensating excellent teachers has driven up tuition fees at independent schools across the country. When factoring in soaring transportation and food expenses, which are essential to every school’s operations, Lakeside’s continuously rising tuition becomes much more explainable. Today, Lakesiders are paying more than ever before — and they know it. In February’s Tatler poll, 93% of 121 answering students said that the price of Lakeside’s tuition was somewhat high or too high. Only eight responses answered that it was too low, somewhat low, or just right.

That said, endowment gifts have consistently covered roughly 75% of tuition fees for students receiving financial aid (as confirmed by Financial Aid Programs Director Tearon Joseph). Those numbers add a layer of nuance to our analysis; though modest growth in financial aid grants has not matched burgeoning tuition revenue dollar-for-dollar, it has kept pace with administrative goals of assisting 30-33% of students every year. As a result, families on financial aid have seen a remarkably steady percentage of their annual tuition erased over the last ten years.

Lakeside is among the few independent high schools that are fortunate enough to cover 100% of calculated need and remain need-blind in the admissions process. While much has been written about the funding gap between public and private schools, due to generous aid policies, tuition should theoretically not be a factor in student admissions and the socioeconomic diversity of Lakeside School.

Still, Ms. Tandon agrees that a high sticker price — $44,730 next year — can “absolutely” discourage some students and their families from applying. That’s in part why Lakeside has recently taken on initiatives aimed at breaking down barriers to equity. In 2012, the admissions office increased outreach to public and Catholic schools, and established a campus tour program that hosted prospective students without requiring them to first apply. In 2018, the Downtown School was launched just west of Seattle Center, an experiment at providing quality education at a lower price point. And in 2024, changes to Lakeside’s dining program will, among other things, raise the percentage of students receiving aid for food from around 10% now to approximately 33% next year.

Lakeside’s long-standing commitment to financial aid is in no small part underwritten by its ever-growing endowment. That’s not to say the system is perfect — current tuition fees may drive away prospective applicants, and students as a whole feel the price to attend is too high. As the school enters its second century, Lakeside and its constituent families will doubtless continue to evolve the system into something more amenable to all. Much about Lakeside may change, but what will remain is a community’s spirit to expand the school’s reach to as many students as possible, a goal only achievable with the investment potential that is the Lakeside endowment.